Global Padel Statistics 2025: Unstoppable Market Growth

13 de April de 2025

Padel, a hybrid of tennis and squash played on enclosed courts, has evolved from a niche pastime into one of the world’s fastest-growing sports in the past decade.

This report provides a data-driven overview of padel’s global landscape, encompassing participation trends, infrastructure growth, economic factors, the professional scene, and comparisons with tennis and pickleball.

Global Participation Trends Report

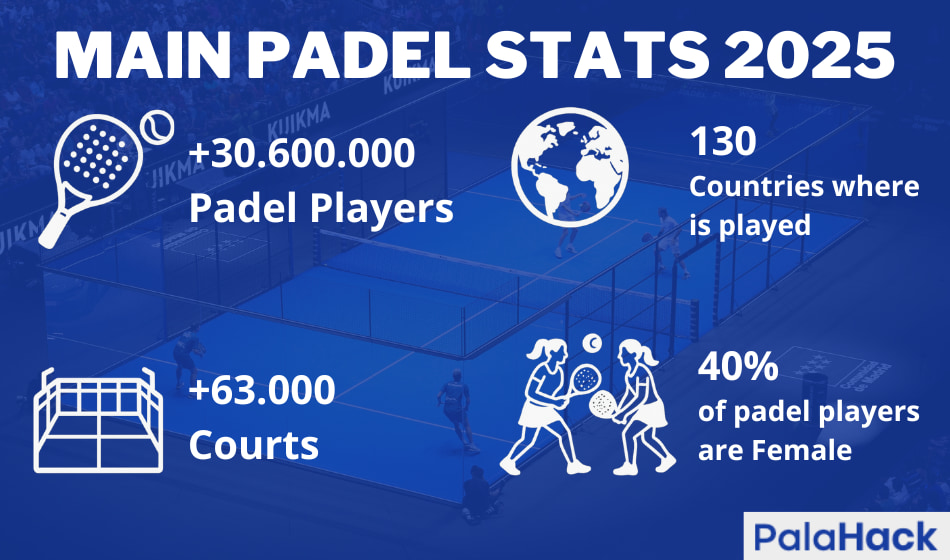

Padel participation worldwide has surged dramatically from 2010 to 2025. Early in the 2010s, padel was primarily popular in Spain and Argentina, with a few million players. By the mid-2010s, the sport was gaining traction in other parts of Europe and Latin America. In 2014, the World Padel Tour (WPT) estimated about 12 million padel players globally, indicating substantial growth from the start of the decade. Fast forward to 2024, and the International Padel Federation (FIP) reports around 30 million people playing padel worldwide– a 2.5× increase in a decade. This makes padel one of the fastest-growing sports globally. Notably, padel is now played in at least 130 countries (up from 90 countries in 2021) as per FIP’s latest survey, reflecting rapid geographic expansion.

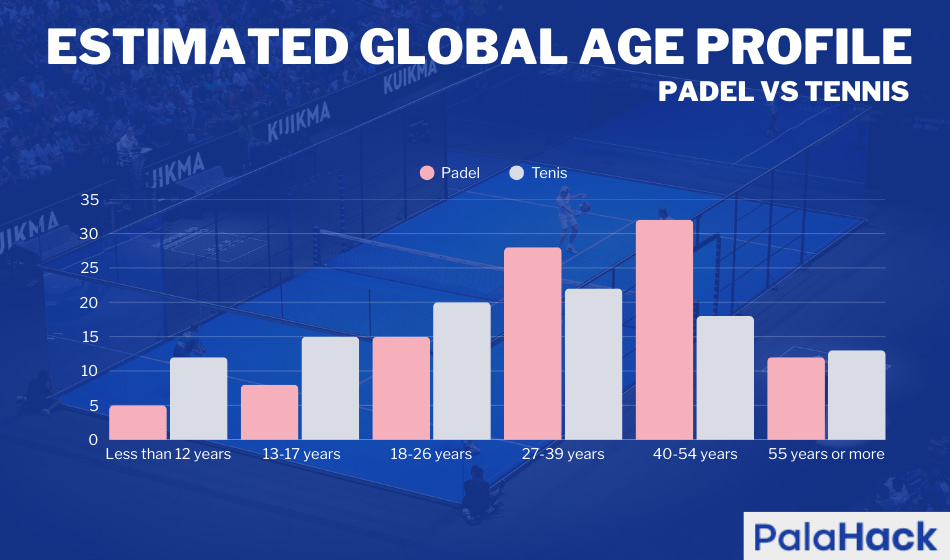

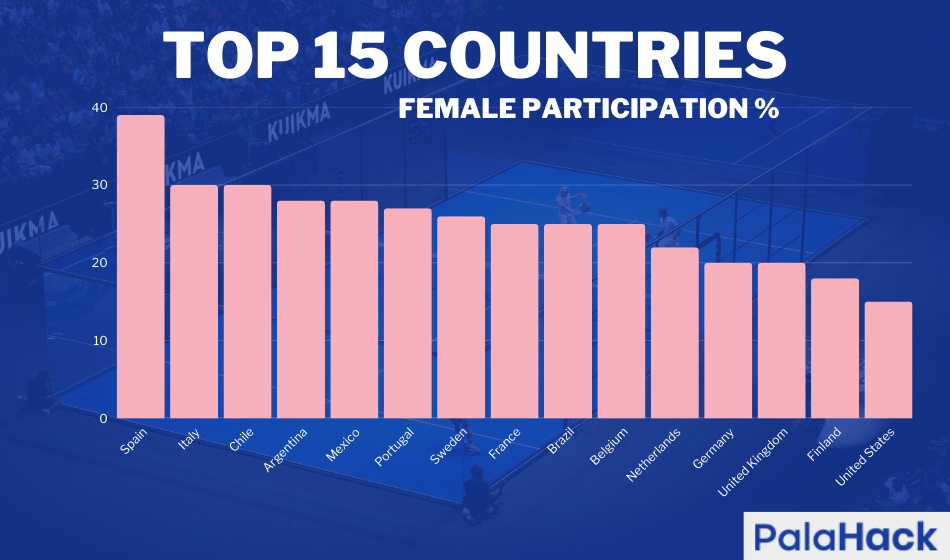

Demographically, padel has broad appeal across genders and ages. Approximately 40% of padel players are female, a relatively high female participation rate for a racket sport (comparable to tennis). Age distribution data is less centralized, but national studies suggest a wide range: for instance, a French survey found players from ages 18 to 70, indicating that all generations are picking up padel. A market analysis by Brainy Insights similarly noted that more than 70% of padel players are over 25 years old, meaning nearly half are younger – a healthy mix of youth and adult participants. This balance suggests padel isn’t confined to one age bracket; it’s attracting young athletes, middle-aged enthusiasts, and even seniors (padel’s doubles format and smaller court make it accessible to older players, much like pickleball).

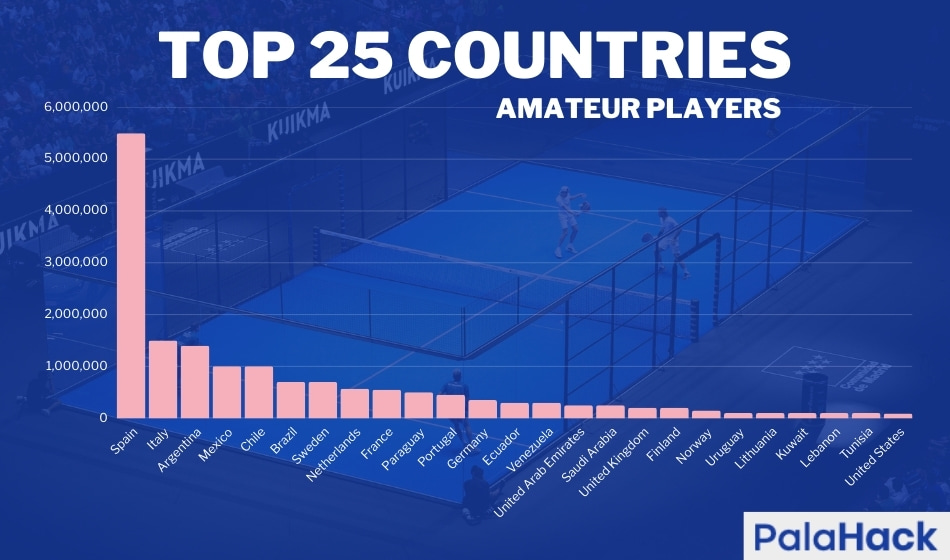

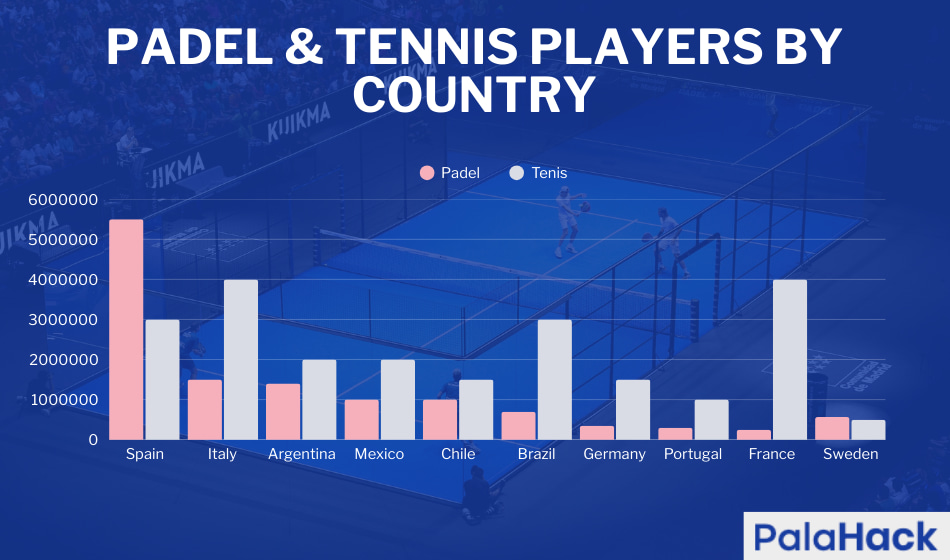

Regionally, Europe remains the epicenter of padel participation. Roughly 59% of the world’s padel players are in Europe, according to FIP’s 2024 report. Spain alone boasts about 5 to 5.5 million players as of 2024 – more than any other country – making padel almost a national sport there. Other European countries have seen a boom: Italy now has over 1.5 million players, becoming the second-largest padel nation, and countries like Sweden (which saw padel players grow into the hundreds of thousands in just a few years after covid) rank among the top in padel participation. Latin America is the next largest region, with Argentina (≈1.4 million players) and Mexico (≈1.0 million) leading a strong following in the sport’s birthplace continent. The Middle East and Asia are emerging markets: e.g. Gulf countries have embraced padel in upscale sports clubs, and minor padel scenes are developing in places like Japan, Australia, and the U.S. (which we’ll detail shortly). In total, FIP counts over 30 million amateur padel players worldwide in 2024, a number that includes casual and frequent players (about half of whom play weekly or more). This global spread is a quantum leap from 2010, when padel was barely known outside Iberia and a few Latin American countries.

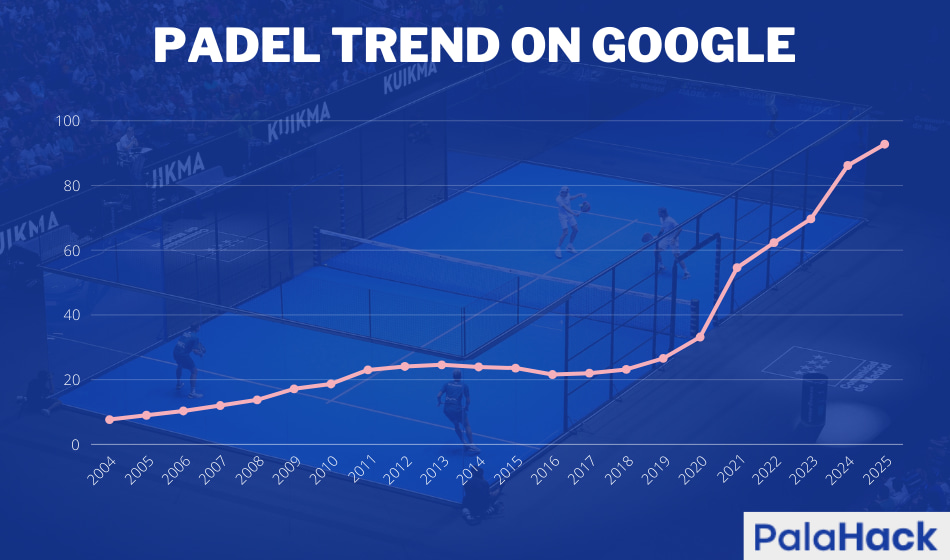

The sport grew from a few million players circa 2010 to ~12 million by 2014 and 30.6 million in 2024 amateurs&federated players. The next chart interpolates known data points (WPT’s 2014 estimate and FIP’s 2024 report) – showing modest growth in the early 2010s followed by a steep rise after 2015. In particular, growth accelerated from 2018 onward as padel expanded beyond its traditional markets and driven also by covid boom.

Spain’s padel boom in the early 2010s (2010–2015) laid the foundation: a research study estimated Spain had ~1.3 million padel players in 2010, which jumped to 4.3 million by 2015 (with much of the increase driven by women and younger players). This explosive growth in Spain and Argentina (plus the launch of the pro tour) helped padel reach ~12 million global players by 2014. The late 2010s saw padel “exported” to new markets – the sport caught fire in countries like Sweden, Italy, France, Portugal, Brazil, and Chile, each building clubs and attracting tens or hundreds of thousands of new players. By the early 2020s, padel’s globalization was in full swing: the number of countries where padel is played jumped from 50+ (2010) to 90 (in 2021) and then to 130 by 2024. Even the United States, where padel had been virtually absent, reached an estimated 90,000 players by 2024 (living with the pickleball boom) – a small base but one poised to grow rapidly (projections for U.S. growth will be discussed later). Overall, padel’s participant base roughly doubled from ~15 million in 2017 to 30 million in 2024.

Gender balance in padel has improved as the sport broadened. The FIP reports 40% of current players are women, reflecting padel’s appeal to both sexes; indeed, many clubs run mixed doubles events and women’s leagues are thriving. In some markets, female participation is even higher (for example, Spain’s federation noted the share of female club members rose markedly over the past decade). Age segmentation shows padel’s accessibility: the core demographic is adults 26–50, but junior and senior participation is rising. (Spain has thousands of juniors competing; FIP counts 1,209 world-ranked juniors in 2024, and veteran categories are popular in club play.) Padel’s moderate physical demands (relative to singles tennis) and its social doubles format make it a lifelong sport – a fact underscored by quotes like tennis pro Dusan Lajović’s: “I can’t wait to retire to play padel every day”.

“Estimates based on federation data, professional player rankings, infrastructure distribution, and market analysis. Values rounded and indicative of general trends as of 2024.”

Regional comparisons: Europe currently dominates padel participation (with ~59% of players), while Latin America contributes a large chunk of the rest. Asia and North America are nascent but growing. To illustrate: by early 2024 the top five countries by player count were Spain (~5.5 M), Italy (~1.5 M), Argentina (~1.4 M), Mexico (~1.0 M), and Chile (~1.0 M).

Many European nations (France, Portugal, Sweden, Belgium, etc.) each count players in the tens or hundreds of thousands, even if they trail the big two (Spain & Italy). The United Kingdom, where tennis is long-established, only recently embraced padel – about 200,000 Britons played padel in 2023 according to Sports England data, and the LTA (Lawn Tennis Association) is now building courts nationwide.

In the Middle East, countries like the UAE, Qatar, and Saudi Arabia have invested in padel courts and hosted pro events, creating a small but enthusiastic player base (no official counts yet, but anecdotal evidence of padel clubs popping up in major cities).

Asia remains largely untapped, though padel is now played in places like Japan, India, and China on a very limited scale. By contrast, South America (beyond Argentina and Chile) has room to grow – Brazil, a sports-loving nation, only has a moderate padel following so far, and initiatives are underway to expand it. These regional nuances mean the next 5–10 years could see a more balanced global distribution of players as new markets catch up to Europe’s padel craze.

Court and Club Infrastructure Evolution

The boom in padel players has been paralleled by a construction frenzy of padel courts and clubs worldwide. Padel is unique in that it requires dedicated courts enclosed by glass and mesh – so growth in participation is directly tied to building new infrastructure. Over 2010–2025, tens of thousands of padel courts have been installed globally to meet demand, often repurposing underutilized tennis areas or new construction. As of 2024, there are an estimated 63,000 padel courts worldwide, spread across roughly 20,000 clubs/facilities. This is a colossal increase from a decade prior: in 2010, only a few thousand courts existed (mostly in Spain and Argentina). For perspective, Spain alone has about 16,000 padel courts in 2024, compared to only ~5,700 tennis courts in Spain – a remarkable statistic showing padel’s infrastructural dominance in its home market. Indeed, in mature padel markets like Spain, Sweden, and Finland, padel courts now outnumber tennis courts, as clubs have rushed to cater to padel’s popularity.

Global padel boom will lead to almost 70,000 courts by 2026.

Europe leads in padel infrastructure: about 70% of all padel courts are in Europe. Spain not only has the most players but also the most courts – approximately 22,000 courts (as of early 2022) according to one source. Other European countries have built courts at breakneck speed. Italy, now the #2 padel nation, has 9,300 courts across 3,495 facilities (by early 2024), whereas it had just a few hundred a few years ago. Sweden similarly jumped to ~5,700 courts by 2022 after covid, a >300% increase from 2019. France, Portugal, Belgium, Netherlands, and the UK are also building courts steadily, although still fewer in number (e.g., the UK had ~470 courts in 2024, up from virtually zero in 2015).

In the Americas, South America accounts for ~24% of global padel courts– Argentina has thousands of courts (historically about 10,000, given padel’s long history there), and countries like Chile, Brazil, Mexico, and Uruguay have significant court counts in the hundreds or low thousands.

The Middle East and Asia have begun investing: the UAE and Qatar have built state-of-the-art padel complexes (including indoor air-conditioned courts), and countries like Egypt and Senegal have started installing courts (FIP notes padel is present in countries as diverse as Iran, Maldives, and Senegal, implying at least some courts exist there).

The United States is a special case: as of 2024, the U.S. had only ~227 padel courts across 71 facilities – tiny by global standards – but new clubs are opening monthly. (For comparison, the U.S. has over 250,000 tennis courts, but many are underused, representing a huge opportunity for padel conversions.) U.S. developers are eyeing padel: large clubs with 8–10 courts have opened in Florida, Texas, and California, and the U.S. Padel Association projects thousands of courts (possibly 20,000–30,000) in the U.S. by 2030 if growth continues.

The infrastructural growth has been nothing short of dizzying. In Spain, padel courts have been popping up in every town – often attached to tennis clubs or built as stand-alone indoor centers. Many Spanish tennis clubs survived the 2010s by adding padel courts on unused land, given padel’s demand and revenue potential. As a result, Spain’s padel courts grew from perhaps 1,000–2,000 in 2000 to 11,000 by 2017, and ~16,000 by mid-2020s (making padel courts ubiquitous across Spanish cities). Italy’s boom is even more recent: after integrating padel under the national tennis federation in 2011, growth was slow until about 2018. Then padel “exploded” in Italy – from only ~50 courts in 2014 to over 9,000 a decade later. Italy’s federation (FITP) had 1,682 affiliated padel clubs and ~74,000 padel members by end of 2023, up from almost nothing ten years prior – an infrastructure and participation surge that even outpaced Italy’s tennis growth. Sweden went from zero permanent courts around 2014 to thousands by 2022, aided by private investors and entrepreneurs treating padel centers as lucrative businesses. This rapid buildout has occasionally outstripped demand – for instance, some reports in 2023 noted Italy’s padel growth was slowing after overshooting in courts, and Sweden saw a slight correction with some padel venues closing when an initial bubble burst. Nonetheless, the overall trend remains strongly upward globally.

The ratio of players to courts is an interesting metric to gauge court utilization. Worldwide, there is roughly 1 padel court per 400–500 players on average. This indicates many players are casual or share court time (padel is typically played 4 per court). For example, in the UK, with ~200k players and 470 courts, there are ~426 players per court – which actually signals undersupply (long booking queues are common in Britain). In contrast, Spain’s 5+ million players on ~16k courts mean ~312 players per court, a somewhat better ratio (yet still, prime-time court slots in Spain can be fully booked days in advance). For comparison, in tennis a common guideline is ~30–60 players per court in active clubs (since tennis is often singles and many players are occasional). Padel’s higher players-per-court ratio reflects that a single court serves 4 players at once and that many padel players play recreationally (not all 30M are playing weekly; only ~15M are “frequent” players per FIP). It also suggests room for infrastructure growth – in many emerging markets, demand exceeds supply of courts. Notably, FIP highlighted that outside of Spain, the number of padel courts increased sixfold between 2019 and 2022, underscoring how new countries had to play catch-up in building facilities once padel caught on.

Another aspect is club structure. The ~20,000 padel clubs/facilities worldwide range from small local clubs (with 2–4 courts) to mega-centers. Spain and Argentina historically had many outdoor courts in public or community clubs. Now, we see high-end indoor padel clubs (with amenities, pro shops, etc.) proliferating, especially in Northern Europe and the Middle East. Commercial chains have emerged: e.g., Padel HQ, Padel Club London, Padel Life and other brands are expanding multi-court centers in various cities. In Sweden, entrepreneurs built large indoor halls with 10–20 courts during the craze. In the US, some pickleball clubs are adding a few padel courts to test the market. Padel courts are also appearing in hotels, resorts, and even private homes of the wealthy (e.g., notable footballers and celebrities building personal padel courts, which speaks to its trendiness). The typical padel club business model – hourly rentals, membership packages, coaching, tournaments – has proven profitable in many locales, driving further investment in infrastructure.

Padel vs Tennis vs Pickleball (Infrastructure):

It’s insightful to compare how padel’s facilities stack up against tennis and pickleball. In Spain, as noted, padel courts (~16k) triple the number of tennis courts (~5.7k), reflecting a major shift in recreational sports preferences over 15 years. In Sweden, a similar story: there are now more padel courts than tennis courts after the recent boom. Europe overall still has more tennis courts (totaling tens of thousands – France and Germany alone have thousands each), but padel is quickly narrowing the gap in some countries. Pickleball, mainly in North America, has an interesting court dynamic: many pickleball courts are temporary or overlaid on tennis courts.

The U.S. had ~44,000 dedicated pickleball courts in 2022, with that number growing ~15% annually. By 2024, the U.S. pickleball court count reached ~68,000 (per USA Pickleball’s database) – surprisingly higher than the global padel court count (~63k). However, pickleball courts are much smaller and cheaper to create (sometimes just painted lines on existing surfaces), so the comparison isn’t apples-to-apples in terms of investment. Tennis still has the largest infrastructure globally: the ITF reported over 100,000 tennis courts in use worldwide (likely a conservative count; one estimate put U.S. tennis courts alone at ~250k including residential courts). But tennis’s growth in courts has been relatively flat or slow, whereas padel and pickleball have grown explosively from zero to tens of thousands of courts in short periods. This indicates shifting preferences in recreational play, with more people gravitating to newer social racket sports.

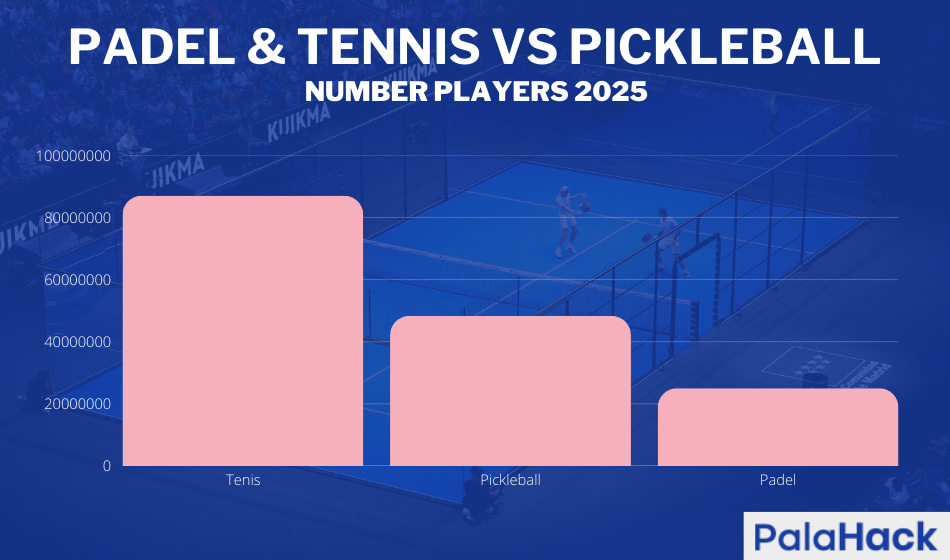

Tennis remains the most played racket sport globally (~87 million players), far ahead of padel (~25 million) and pickleball. However, padel’s growth rate outpaces tennis, and pickleball (while at ~19 million U.S. players) is skyrocketing in its region.

Economic Indicators: Costs, Membership, and Market Size

As padel participation expanded, an economic ecosystem formed around the sport – including court rental fees, club memberships, equipment sales, coaching, and event tourism. This section examines the cost to play padel, trends in club membership, typical court pricing, and the padel equipment market, along with how these compare to tennis and the burgeoning pickleball market.

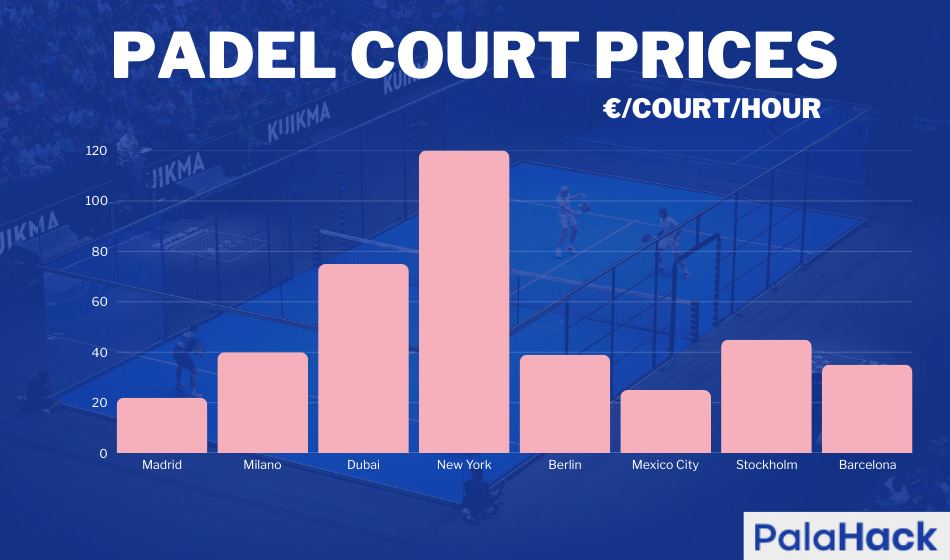

Cost to play: Padel is generally a pay-to-play sport (outside of a few public courts), and costs can vary by region and facility level. On average, renting a padel court costs about €20–€60 per hour on weekdays, and €25–€70 per hour on weekends (per court) in Europe. Split four ways, this is roughly €5–€12 per player, per hour – a cost similar to or slightly higher than recreational tennis. For comparison, tennis court rentals average €10–€25 per hour on weekdays, €15–€30 on weekends in many European clubs, notably lower than padel. This difference arises because padel courts are newer (often private facilities with higher fees), and demand often exceeds supply, allowing clubs to charge a premium.

In emerging padel markets like Latin America or the Middle East, prices differ: e.g., in Argentina, court fees have historically been lower (padel being more grassroots there), while in Dubai or London, prime-time padel court fees can be quite high (reflecting affluent clientele). The BusinessDojo analysis notes that urban padel centers often charge $30–$50 per hour in major cities aligning with the European range when converted. Some clubs offer monthly membership packages for frequent players (e.g., unlimited play for a flat rate), but pricing for such subscriptions varies widely and wasn’t easily averaged (due to differences in club models).

The specialized padel court infrastructure and high demand drive up rental prices than tennis, and padel rackets (which contain foam and carbon fiber) tend to wear out faster than tennis rackets, leading to more frequent replacement costs.

Federation license trends:

Official “membership” in padel can refer either to club membership (paying an annual fee for a club) or federation license membership (registering with a national federation to play leagues/tournaments). Both have grown significantly alongside participation.

In Spain, the number of federated padel players (those holding an official license with the Spanish Padel Federation) jumped from just 39,000 in 2012 to over 100,000 in 2024, a milestone where padel surpasses tennis in Spanish federation memberships. (This is remarkable given tennis is a long-established sport in Spain – padel now has more people formally competing.) Spain saw a 22% surge in padel licenses in 2021 alone, reaching ~96,872 by end of 2021, and continued growth to break 100k in 2024. Similarly in Italy, federation-backed padel membership reached almost 74,000 by 2023 under the FITP, and Italy now claims to be the world’s largest padel federation by members (possibly overtaking Spain briefly until Spain’s recent record – the timing of stats may vary). These federation numbers, while impressive, still represent a small fraction of total players (e.g., 100k of Spain’s ~5 million players). This is common in leisure sports: only a subset competes or joins official bodies. Nonetheless, the upward trend in memberships reflects growing competitive and club engagement.

Court rental prices naturally vary by region and time. Some illustrative cases: In Sweden, off-peak padel rentals dropped in price as supply grew (to entice players during daytime). In the UAE, indoor AC padel courts can command premium prices (e.g., ~$60/hour). In Latin America, local clubs might charge the equivalent of $10/hour (affordable by global standards).

Equipment market size:

The padel equipment market has exploded to support millions of players. This includes padel rackets, balls, shoes, apparel, and accessories (bags, grips, etc.). According to Statista, the global market for padel equipment was around €500 million in 2022, and growing fast. By comparison, the tennis equipment market was over three times larger (exceeding €1.5 billion). This shows padel still lags tennis in economic terms, but it’s closing the gap given the growth rate. Various market research reports forecast double-digit annual growth for padel equipment sales through the 2020s. For instance, one analysis projects the padel racket market to grow from ~$115 million in 2023 to ~$312 million by 2030 (12.6% CAGR) as this study. The drivers are clear: millions of new players need rackets and balls, and existing players replace gear frequently. Padel rackets typically cost $50–$300 (most mid-range models ~$100–$200), and advanced players often buy new rackets every 6–12 months. Balls are sold in tubes of 3, costing $5–$7, and need replacing after a few games for optimal bounce (similar to tennis balls), even using pressurizers that extend their useful life very efficiently. Shoes and apparel are often crossover from tennis, but padel-specific shoe lines exist (focusing on grip for artificial turf).

Major brands in padel equipment include both specialized padel companies (e.g., Bullpadel, NOX, Babolat Padel, Head Padel, Drop Shot) and traditional tennis brands expanding into padel (Wilson, Head, Adidas, etc.). The competition has driven innovation: for example, new racket surface textures for spin, or vibration-dampening technologies to reduce injury. There’s also a significant market for court construction and maintenance (artificial turf, glass walls, lighting), often handled by specialized firms (some like Mondo and GreenSet, known for tennis, now produce padel court materials). While not usually counted in “equipment” sales, the padel court industry is a multi-million dollar business on its own, with each court installation costing $20k–$40k. The boom in court construction from 2015–2025 undoubtedly pumped hundreds of millions into suppliers of turf, glass, aluminum frames, etc.

Professional Scene: Players, Tours, Prize Money, and Media Reach

Padel’s professional scene has transformed from a semi-amateur circuit in the 2000s to a globally watched, multi-tour sport by 2025. This section explores the number of professional players, the evolution of prize money, the rise of the World Padel Tour (WPT) and Premier Padel tours, and padel’s media footprint.

Number of professional players:

According to FIP’s 2024 report, there are 4,874 players with a professional ranking worldwide. This encompasses players who have earned points on FIP-sanctioned tours (including Premier Padel, A1, and FIP Futures events). It indicates that nearly 5,000 players have competed professionally (even if many only at lower-tier tournaments). Of those, the truly full-time pros are a smaller subset – likely a few hundred who play the main tours regularly. 1,209 world-ranked junior, highlighting a pipeline of youth talent coming up through sub-18 competitions. In terms of geography, professional padel was long dominated by Spain and Argentina (most top players hail from these two nations). As of 2023, players from countries like Brazil, Chile, France, Italy, and Sweden have broken into the top tiers, though the elite ranks are still Spanish/Argentine heavy. On the women’s side, Spain and Argentina also dominate, with a growing presence of Italian, Portuguese, and Swedish players in the rankings. Britain, the U.S., and others have only a handful of pros so far (e.g., Britain had 54 male and 34 female FIP-ranked players in 2024, mostly lower-ranked). In total, the professional padel scene has become truly international: players from about 30+ countries appear in the rankings, compared to maybe 10 countries a decade ago.

The World Padel Tour (WPT), launched in 2013, was the main pro circuit through the 2010s. It built on earlier Spanish-based circuits (Padel Pro Tour) and expanded events internationally. By the late 2010s, WPT was hosting ~15–20 tournaments a year, mostly in Spain with a few abroad, and had developed a professional structure with rankings, sponsors, and broadcast agreements. By 2019, WPT had tournaments in 3 continents and drew 285,000 spectators on-site over the season, with over 3 million TV/stream viewers globally. These numbers show that even before the 2020s boom, there was a substantial audience for pro padel. WPT significantly increased prize money over the years (though it was still modest relative to tennis). For instance, in 2015/16 the top male padel players earned around €80k–€100k in prize money for the season (Fernando Belasteguín made ~€106k in 2015), whereas back in 2010 the top players made under €45k – so prize earnings roughly doubled in that half-decade. WPT’s growth was fueled by sponsorship deals (e.g., with Estrella Damm, Adidas, and later CUPRA) and increased professionalism.

However, a major shake-up began in 2022: Premier Padel, a new tour founded by the International Padel Federation (FIP) in partnership with Qatar Sports Investments (QSI) and the players’ association, launched as a rival global circuit. Premier Padel offered significantly higher prize money and a vision to globalize padel further (with events in venues like Roland Garros and big stadiums). In Premier Padel’s inaugural 2022 season, it hosted 4 “Major” tournaments and a few smaller ones, offering prize purses far above WPT’s. For example, Premier Padel Major winners earned €47,300 each in 2022, compared to ~€18,000 for a WPT Master Final winner that year. This injection of money forced WPT to respond by raising its own prize money and eventually led to an agreement: in 2023, QSI (Premier Padel’s backer) acquired the WPT, and from 2024 onward the tours are unified under the Premier Padel name. This is a historic moment – effectively creating one consolidated world tour under FIP governance, analogous to the ATP/WTA in tennis.

With unification, the pro calendar in 2024 and beyond features more events across more regions. WPT (2013–2023) laid the groundwork with events in Europe and some in the Americas; Premier Padel (2022–2023) expanded to the Middle East and new markets. Now, the unified tour (still called Premier Padel) aims to cover all key regions. In 2025, Premier Padel plans 24 tournaments across 16 countries, truly making it a global tour. This is a huge increase from a decade ago when nearly all pro events were in Spain/Argentina. We also see far greater inclusion of women’s events: WPT always ran parallel men’s and women’s draws; Premier Padel initially launched with men’s events only but added women’s draws in 2023. By 2024, the unified tour features both genders at all major events, doubling the professional opportunities for female padel players.

Prize money evolution:

Prize money in padel, while still small compared to tennis, has grown impressively. In the early 2010s, padel tournaments had prize pools in the tens of thousands of euros. By late 2010s, a WPT Open had a total prize purse around €90k (with winners ~€9.8k each). WPT Master events were around €110k total purse (winners ~€11k each), and the year-end Master Final total ~€110k (winners ~€17.7k). Premier Padel blew this open: a Major event has a €525k purse (winners €47k), and even its smaller P1 events have €125k–€250k purses. The total season prize money on the unified tour in 2024 likely exceeds €5–€6 million across all events, a record for padel. Top players (especially men’s, as their draw sizes are larger and historically had more events) can now earn a few hundred thousand euros in a good year of results. Still, to put it in perspective: the #1 tennis player (e.g., Djokovic) earned about €9.7 million in 2012 from tournaments, whereas the #1 padel player in 2022 might have earned ~€200k. So tennis is an order of magnitude higher in prize money. But padel’s trend is upward – players are finally able to make a solid living, at least at the top. The prize money to players ratio is improving too: more tournaments and higher purses mean more players earning some prize income. (Yet, beyond the top ~20–30 players, padel pros still struggle financially and often rely on sponsorships/coaching jobs to supplement income – an issue to monitor as the sport grows.)

Professional player earnings and sponsorship:

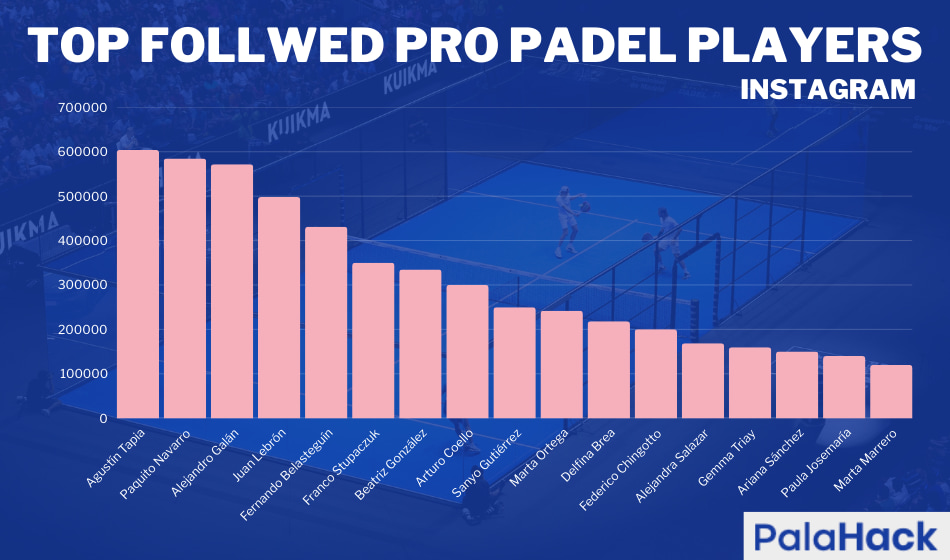

Sponsorship deals for padel pros have also increased. Top players like Juan Lebrón, Alejandro Galán, Gemma Triay, and Alejandra Salazar have endorsements with racket brands, sportswear companies, and other sponsors (some even appear in ads with global icons – e.g., taping commercials with Rafael Nadal or football stars, leveraging padel’s celebrity appeal). The involvement of celebrity investors (e.g., footballers Beckham, Ibrahimović, and others have invested in padel clubs or franchises) boosts the profile of the pro game. In terms of sheer numbers, currently only a relatively small number of padel players (perhaps 50–100 players) earn enough from prize money and sponsorship to be full-time pros without financial strain. This is an improvement from 10 years ago, when only the top 5 or 10 could claim that. As a metric, an ITF report noted “only 350–400 tennis players can fully live off the sport worldwide”– padel might reach a similar number in the future if revenue keeps rising.

Media reach and audience:

The growth of professional padel is tightly linked to media coverage. Initially, padel’s reach was mostly local TV in Spain/Argentina and streaming through YouTube. WPT innovated by offering free YouTube streams of matches, which garnered millions of views globally (22.7 million YouTube views in Premier Padel’s first season 2022, similar figures for WPT streams). This digital strategy built an international fanbase even in countries without TV broadcasts. Now, with more money in the sport, broadcast deals have expanded to major sports networks. Premier Padel secured multi-year agreements with networks like ESPN (Latin America), beIN Sports (covering 37 countries in MENA and Asia), Sky Sports (Italy/UK), Canal+ (France), etc. By 2023, professional padel was being televised in over 180 countries, reaching an estimated 150 million households. Those are significant numbers, comparable to second-tier global sports. Social media following for padel is also notable: the WPT’s official Instagram has over 1 million followers, and players like Paquito Navarro or Marta Ortega have hundreds of thousands of followers, indicating strong fan engagement.

In terms of global media narrative, padel is frequently covered as “the fastest-growing sport you haven’t heard of” in international press. By 2025, major outlets like the Guardian and BBC have run features on padel’s rise, and sports channels include padel highlights. Public figures (e.g., football coaches like Jürgen Klopp and athletes like Cristiano Ronaldo) playing padel have been news items, indirectly boosting padel’s media profile. There are also dedicated padel media now (websites, magazines, YouTube channels) catering to fans, have emerged in the 2020s.

Integration with global sports frameworks:

The FIP is actively pushing for padel to be included in multi-sport events (it was a demonstration sport in the 2019 European Games, and an official sport in the 2023 European Games). The ultimate goal is the Olympics; while padel will not be in Paris 2024, efforts are ongoing for Los Angeles 2028 or Brisbane 2032. Olympic inclusion would massively increase media exposure and funding, likely accelerating all trends discussed.

Projections to 2030: Participation, Infrastructure, and Revenue Forecasts

Looking ahead to 2030, the trajectory of padel suggests continued global growth, though the rate may moderate as the sport reaches a more mature phase in some regions. Here we outline projections and expectations for padel’s participation numbers, court infrastructure, and market size by 2030, and consider how it might compare to tennis and pickleball at the end of the decade.

Participation projections:

Based on current trends, padel could plausibly double its global player base again by 2030. From 30 million in 2024, one scenario is ~50–60 million padel players worldwide by 2030, which would imply an average ~10% annual growth. This growth will likely be driven by new regions. For example, North America is expected to be a major growth engine: industry leaders in the U.S. foresee 8–15 million U.S. padel players by 2030 if courts are built at the projected pace. Even using a conservative midpoint (~10 million U.S. players by 2030), that alone would boost global numbers significantly (up from 90k in 2024). Asia could be another frontier – if countries like China or India pick up padel in any meaningful way, the sheer population could add millions of players. It’s hard to predict, but efforts by padel manufacturers and federations are underway to introduce padel in Asian markets. Europe should continue to grow but perhaps at a slower rate as some markets saturate. Spain might level off around 5–6 million (most of those who want to play already do), but countries like Germany, UK, Eastern Europe, etc., which are currently underdeveloped in padel, could see big increases. Latin America may also continue growing; Brazil in particular is seen as having untapped potential to add hundreds of thousands of players. Overall, a realistic projection might be: 50M players by 2030 (with upside to ~70M if multiple large new markets break out).

From a comparative view, if padel hits ~50 million players, it would rival or exceed sports like golf (which has ~66M players worldwide) and approach half of tennis’s base (tennis might grow to ~120M by 2030). Pickleball, focused in the U.S., could also have tens of millions by 2030 – some estimates say 20–40 million Americans playing pickleball by 2030 (one report even posits 50M by 2025, which seems very optimistic). If both padel and pickleball flourish, they may coexist, appealing to slightly different demographics and geographies (padel more popular in Europe/LatAm, pickleball in North America, with some overlap).

Infrastructure projections:

To support the projected players, padel will need many more courts. By 2030, global padel courts could easily exceed 100,000 courts. Europe might see moderate expansion – perhaps reaching ~60k–70k courts (up from ~42k in 2024) if every city adds more. The biggest jumps will be elsewhere: the U.S. could have 10,000–30,000 padel courts by 2030, per USPA projections. (Even the low end, 10k, is a huge rise from 227 courts now, implying many new clubs coast-to-coast.) The Middle East may continue building premium padel clubs (Saudi Arabia, for instance, is investing in sports and could build large complexes). In Asia, if China embraces padel even at a niche level, thousands of courts might pop up (China has started to show interest – a handful of courts exist in Shanghai/Beijing now, possibly accelerating by late 2020s). Latin America should grow too: Brazil’s tennis clubs might add padel en masse, and countries like Colombia or Peru might develop scenes. By 2030, a scenario could be: Europe ~65k courts, Americas (N/S combined) ~40k courts, Asia+ME ~15k, rest ~1k, totaling ~120k. If growth is a bit slower, perhaps ~80k–100k courts globally.

One interesting projection: USA Pickleball noted that pickleball needs 25,000 more courts by 2030 to meet demand sfia.org. Padel, starting from a smaller US base, might need a similar number (20k+ courts) just to catch up. In infrastructure terms, by 2030 padel courts could be as common in parts of Europe as tennis courts are, and in parts of the U.S. as common as squash/racquetball courts once were.

In terms of clubs, the number of padel clubs worldwide might double from 20k to 40k by 2030, given many new venues opening especially in new markets. This could include a mix of dedicated padel centers and multi-sport clubs. We may also see more integration: for instance, fitness centers adding a padel court, or residential complexes including padel courts as amenities (a trend already starting in some upscale developments).

Economic and revenue forecasts: With more players and courts, the padel market will grow in value. As noted, estimates put the padel equipment market on track to reach $700–$900 million by around 2030 businessresearchinsights.com. Adding in other revenues (court bookings, memberships, sponsorships, media rights), the total padel industry could be several billion dollars by 2030. For example, if 50M people play padel in 2030 and each spends an average of $50 per year on equipment and fees (a conservative assumption), that’s $2.5 billion in consumer spending per year. The actual figure might be higher for active players (club players often spend a few hundred per year on fees, plus equipment). Also, professional tour revenues (sponsorship, broadcast deals) will factor in: by 2030 the unified tour may have lucrative media rights deals, perhaps generating tens of millions annually (if not more).

It’s also instructive to consider padel vs pickleball vs tennis in 2030: Tennis will remain larger in absolute size (maybe 120M+ players), but its growth is slow; padel and pickleball are taking a share of the casual racket-sport enthusiast market. The three sports may each carve distinct territories: tennis as the legacy sport with high professional glamor, padel as the trendy social sport across Europe/LatAm/Asia, and pickleball as the casual accessible game especially for older age groups in the U.S. They may also increasingly overlap – for instance, tennis clubs offering all three, and players cross-participating. We might see combined multi-racquet sport complexes (some entrepreneurs already float the idea of clubs with tennis, padel, pickleball, badminton all under one roof, to maximize utilization).

Professional scene in 2030: If padel continues on its current path, by 2030 the pro tour could be quite lucrative. It’s conceivable that the top players in 2030 could be earning €1 million+ per year in prize money and endorsements, if viewership and sponsorship grow (still below tennis top stars, but a huge leap from today). The tour might have even more events, possibly including in the U.S. (imagine a New York or Los Angeles Open of padel by late 2020s). If padel becomes an Olympic sport in 2032, the lead-up in 2030 will see a spike in interest and funding from national Olympic programs, likely boosting participation and professional depth in more countries (like how inclusion in the Olympics spurred sports like table tennis or badminton globally).

Conclusion

Looking ahead, padel’s trajectory remains very positive. By 2030, we expect tens of millions more players, especially as North America and Asia join the padel movement. The infrastructure gap is closing with aggressive court construction, and the sport’s revenue streams – from local court bookings up to international sponsorships – are expanding. Padel’s appeal lies in its social, fun nature and moderate learning curve, which positions it well in a world seeking active, social recreation.

For clubs, investors, and federations reading this report, the data underscores padel’s viability as a long-term venture. The comparative analysis also suggests synergy rather than zero-sum competition among racket sports: padel can thrive alongside tennis and even collaborate (as seen by joint federations and multi-sport clubs), and lessons from pickleball’s community-driven growth can inform padel’s outreach in new markets. The key is to continue monitoring trends with robust data. As recommended, establishing regular global surveys for padel participation and publishing annual “state of the sport” reports (like FIP’s 2024 World Padel Report) will help identify gaps and opportunities – be it a region needing more investment or a demographic group that could be targeted to grow the game further.

Finally, one cannot ignore the cultural impact padel has begun to have. It has become ingrained in Spanish and Latin lifestyle, is a fashionable sport for celebrities, and for many, a preferred way to stay fit and socialize. If the 2010s were the decade padel took root, the 2020s are the decade it blossoms worldwide. By 2025, we’re midway through that journey, with padel firmly established as a global sport in its own right. The numbers and trends in this study tell a clear story: padel’s rise is real, significant, and shows no signs of slowing down. Whether as a player, club owner, or investor, engaging with this sport promises an exciting ride in the years ahead.

Bibliography

- FIP (2024). World Padel Report 2024. International Padel Federation.

- López-Carril, S., & Anagnostopoulos, C. (2017). Evolution of padel in Spain according to practitioners’ gender and age. ResearchGate.

- Statista (2023). Number of padel courts worldwide from 2016 to 2023. https://www.statista.com/statistics/1473603/padel-courts-worldwide/

- Business Research Insights (2024). Padel Market Size, Share, and Growth Report 2024. https://www.businessresearchinsights.com/market-reports/padel-market-102910

- SFIA (2024). Pickleball sees unprecedented growth: Will require 25,000 courts and $900 million investment. Sports & Fitness Industry Association. https://sfia.org/resources/pickleball-sees-unprecedented-growth-will-require-25000-courts-built-900-million-investment-to-keep-up-with-demand/

- Horowitz, J. (2022, February 11). Padel takes off in Italy: ‘No sport has had such success in so short a time’. The Guardian. https://www.theguardian.com/world/2022/feb/11/padel-italy-takes-off-no-sport-such-success-so-short-time

- FIP (2024). Focus on Italy: The second country in the world for padel clubs and courts. https://www.padelfip.com/2024/06/focus-on-italy-the-second-country-in-the-world-for-padel-clubs-and-courts/